Are you a real estate agent that has sold a home in New Jersey in the last six years?

Were deductions made from your pay by the real estate agency you worked for?

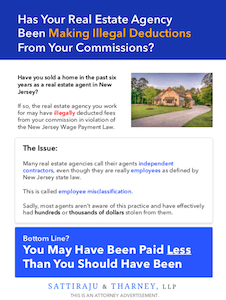

If you answered yes to both of these questions, you may have been misclassified as an employee and underpaid.

Sattiraju & Tharney has brought an important case against Weichert Realtors that is currently before the New Jersey Supreme Court. Our firm represents real estate agents in a class action lawsuit filed against Weichert based on its alleged violations of the New Jersey Wage Payment Law. We allege in our lawsuit that Weichert misclassified its agents as independent contractors, and that these workers were actually employees as defined by the New Jersey Wage Payment Law.

Misclassification of real estate agents as independent contractors is a serious issue that can result in real estate agents being significantly underpaid. Misclassification can occur when the contract entered between the real estate agent and agency states that the agent is an independent contractor, but the actual relationship is legally an employer/employee relationship as defined in the New Jersey Wage Payment Law. It is important to note that the law controls whether an employee is an employee or independent contractor, and not the contract between the parties.

Download Our Free Guide

Are you a real estate agent in the state of New Jersey? Find out the specific signs that indicate you may have been misclassified, as well as what the ABC Rule is.

Download Now

Are You an Employee or Independent Contractor?

New Jersey courts look at several factors to determine whether a worker is truly an independent contractor or an employee.

Some key issues include:

- Whether the worker is free of the realtor’s direction and control. If the worker is an independent contractor, then the realtor should be mostly focused on whether the house sells and not much else.

- Whether the worker provides services outside the employer’s usual course or places of business. If not, they look like an employee.

- Whether the worker has an independent business, trade, or occupation. If you do, then you are probably not an employee and should not be treated like one.

If a real estate broker tells an agent when and where to work, and if the broker instructs the agent what to say when showing a home, then the worker should be classified as an employee and not an independent contractor. This is also true if the broker prohibits a real estate agent from working with other brokers.

The New Jersey Wage Payment Law protects employees against illegal deductions from their compensation. If a real estate agent is misclassified as an independent contractor, the real estate agency may have illegally deducted or required fees and payments. Those illegally deducted or required fees and payments may include:

- marketing fees;

- MLS fees for listing and membership;

- costs for “collection and marketing”;

- trade association dues;

- medical insurance;

- automobile liability insurance;

- travel expenses;

- real estate organization membership fees;

- mailing expenses;

- business cards and

- other illegal fees.

Misclassifying real estate agents as independent contractors benefits a real estate agency because it allows the agency to shift operating costs and other expenses onto the real estate agents. Unfortunately, most real estate agents are not aware of employee misclassification and do not know that they should really be defined as employees under New Jersey state law. As a result, real estate agents have unknowingly had many thousands of dollars illegally deducted from their compensation by their real estate agency.

The New Jersey Wage Payment Law protects the rights of employees, including real estate agents, who have been misclassified and underpaid. Under the New Jersey Wage Payment Law, you have six years to file a claim for unpaid wages. You may have a claim for unpaid wages against the agency that you work or worked for (while designated as an independent contractor) if you can meet two initial criteria. First, you must have sold a home in New Jersey within the past six years. Second, you had deductions similar to those listed above made from your compensation by a real estate agency during those six years.

If you did sell a house in New Jersey within the last six years and had deductions made from your compensation, you should consult with an attorney experienced in the area of wage payment litigation. Ravi Sattiraju has been appointed as Class Counsel in numerous wage and hour litigations in both state and federal courts. Our firm protects the rights of real estate agents under the New Jersey Wage Payment Law and other state wage laws.

To discuss your claim, please contact us for a free consultation at (609) 469-2110. For more information about our firm’s work on wage payment cases, you can visit our website.

Don’t let your real estate agency steal your commission.

Call us for a free consultation:

(609) 469-2110

Common Questions About Misclassification

What Are Signs I’ve Been Misclassified and Underpaid?

If you were a real estate agent at any point in the last six years and made a sale, it is very likely you have had money taken out of your commission statements illegally. All you need to do is look at your commission statement. If you see deductions such as Marketing Fee or Office Fee, you’ve very likely been underpaid.

Why Do Real Estate Agencies Misclassify Agents?

By wrongfully deducting expenses, agencies pass their operating expenses onto agents — saving them thousands of dollars each year.

What Can I Do If I was Misclassified?

You should consult with an attorney experienced in the area of wage and hour litigation. Real estate agents may be entitled to recoup deductions illegally taken from their commission statements

How Long Do I Have To File a Claim?

Under the New Jersey Wages Payment Law, you have six years to file a claim for unpaid wages.